Financial Success in Childcare: 10 Essential Tips for Providers

Running a childcare business is rewarding but can also be financially challenging. Balancing the needs of the children in your care with the financial stability of your business requires careful planning and savvy money management. In this blog post, we'll explore ten essential financial tips for childcare providers, each with detailed explanations to help you navigate the financial landscape of your childcare business.

1. Create a Detailed Budget

One of the foundational steps for financial success in childcare is creating a detailed budget. List all expenses, including staff salaries, rent, utilities, and supplies. Be sure to account for unexpected costs that may arise. Regularly review and adjust your budget as needed to maintain financial stability.

2. Set Clear Pricing Policies

Your pricing policies should be clear and transparent. Parents should understand your tuition rates, payment schedules, and any discounts or late fees. A clear policy will help avoid misunderstandings and ensure consistent revenue flow.

3. Diversify Your Income Streams

Don't rely solely on tuition fees. Explore additional income streams, such as offering after-school programs, holiday camps, or parent night-out offerings during the weekend. Diversifying income can help stabilize your finances.

4. Emergency Fund

Create an emergency fund to cover unexpected expenses. This safety net can prevent you from dipping into your operating budget when unforeseen financial challenges arise.

5. Expense Tracking and Optimization

Keep meticulous records of all expenses and regularly review them. Identify areas where you can cut costs without compromising the quality of care you provide. Even small savings can add up over time.

6. Tax Planning

Consult with a tax professional who specializes in childcare businesses. They can help you take advantage of tax deductions and credits specific to your industry, ensuring you keep more of your hard-earned money.

7. Efficient Staffing

Labor costs are often the most significant expense for childcare providers. Ensure your staff-to-child ratio is efficient while maintaining high-quality care. This balance can help control staffing expenses.

8. Insurance Review

Periodically review your insurance policies to ensure adequate coverage for liability, property damage, and other potential risks. Failing to have the right coverage could lead to significant financial setbacks.

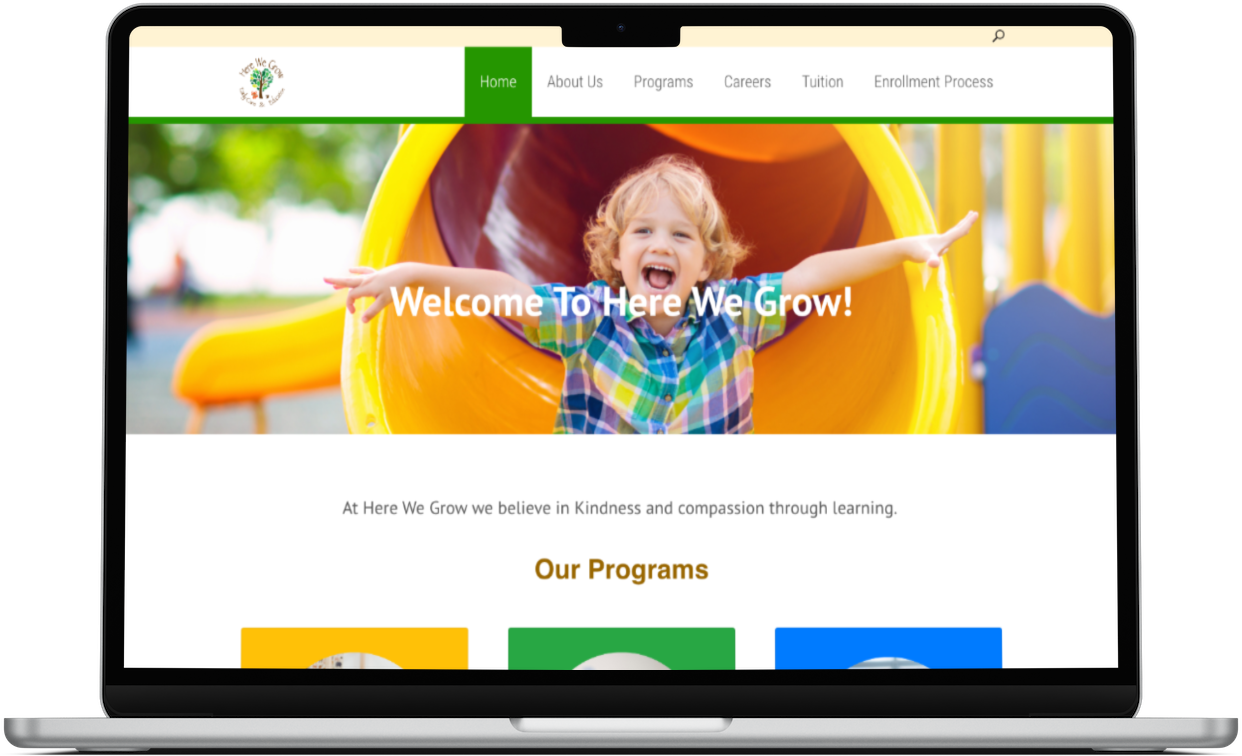

9. Marketing and Enrollment Strategies

Enhance your marketing efforts to drive enrollment growth. Invest in a well-designed childcare website, keep it up-to-date, and leverage the power of social media to spotlight your childcare facility, dedicated staff, and engaging educational activities. A steady stream of enrollments is crucial for financial stability. Using online enrollment and childcare forms facilitates this process.

10. Professional Development

Invest in ongoing training and development for your staff. Well-trained employees can enhance the quality of care and increase your facility's appeal, potentially attracting more parents and children.

Running a childcare business can be financially rewarding when you take a proactive approach to managing your finances. By following these ten financial tips for childcare providers, you can maintain a stable business while providing exceptional care and education to the children in your care. Remember, financial success in childcare is achievable with careful planning, diligence, and a commitment to delivering quality services.

547